Insight on Malaysia’s Digital Maturity

2022/4/1

Author: Aqmar Zakaria

Introduction

According to a report published in tandem by Google, Temasek, and Bain & Company, Asia is home to 4.2 billion people and the fastest-growing digital economy that is expected to grow by 200% in the next four years [1]. Two of the world’s fastest digitising countries in the world are India and Indonesia, which belong to the APAC region, and half of the amount of internet consumption in the next ten years is going to happen in Asia. Asia holds growth potential and there is already momentum to rise higher at least in the next five or ten years. Furthermore, Asia has gone through technology transformation before the COVID-19 pandemic, which helps the economy endure the crisis quite well. Therefore, in this article, I will enlighten the readers on digital maturity in Asia, particularly Malaysia.

Just to share a brief of my journey and how I ended up currently working in Japan. Malaysia is my home country but I have been spending my adult life abroad since I was 20 years old where I lived for 3 years in France for my bachelor’s degree study. After finishing my study in France, I moved back to Malaysia for my Master’s study then I came to Japan for my Ph.D. study and now it has been my fourth year in Japan. Since I am originally from Malaysia, I am happy to write about Malaysia’s digital maturity. Another reason for writing this article is that three months ago, I had an opportunity to have a meeting with an executive of a leading BPM vendor whose responsibility includes the APAC region. My team presented on APAC’s digital maturity since both companies have a mutual goal to expand their business into APAC. It took us around a month to do research on digital maturity across APAC and we did a comparison between three countries, Malaysia, Thailand, and Japan – representing three members who came from these three countries.

Shifting investment priorities

Since the onset of the COVID-19 pandemic, organisations across the globe have adopted and leveraged digital technology to mitigate the impact of the pandemic on businesses. Employees have been engaging in remote work during the pandemic which demands employers to leverage digital technology in their business operations. Remote work trend will stay not only due to omicron infection surge across the globe but businesses found that the productivity is better when their employees engage in remote working [2]. Therefore, going digital is no longer optional but becomes a must for businesses to stay competitive and resilient. Due to these reasons, businesses around APAC have been shifting their investment priorities into digital adoption efforts to optimise business processes and sustain the growth during the pandemic and post-pandemic, realising the digital era is not in the future but it is happening [3].

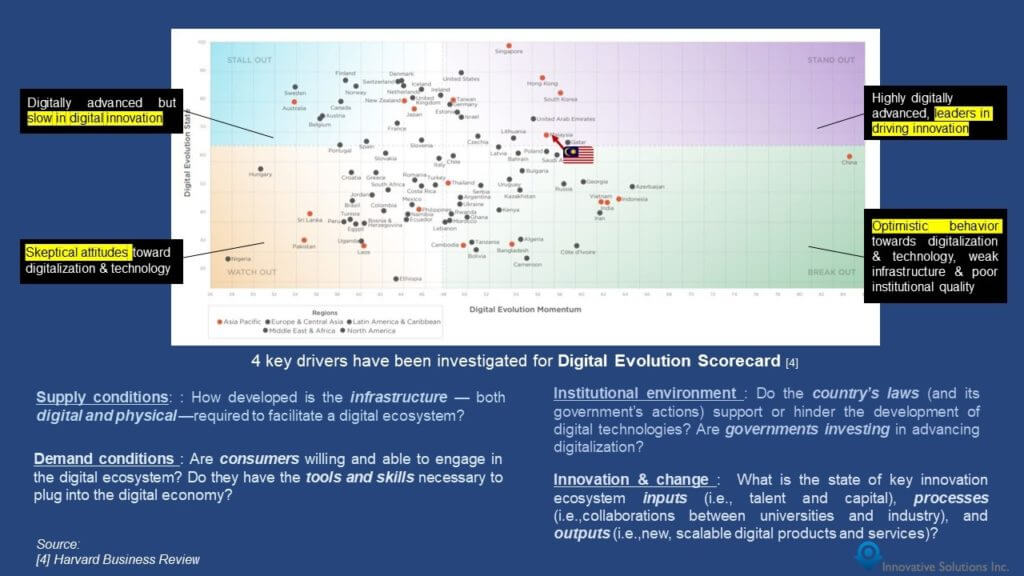

Digital Evolution Scorecard

Digital Maturity

Generally, digital maturity is a measure to indicate the digital technology adoption effort and its state. These include the infrastructure setup, key investments to support the infrastructure setup, institutional environment, and availability of digital or IR4.0 technology. In this article context, a country with a high level of digital maturity has an advanced internet infrastructure, supportive government policies to establish a digital ecosystem in the country, and a high number of innovations in the country. On the contrary, countries with low levels of digital maturity struggle to embrace recent digital technologies.

As I mentioned in the introduction part, this digital maturity information is part of our presentation during the meeting with the leading BPM vendor. I learned during the meeting how advanced it is in business in the Western part particularly the United States in deploying digital technologies. Meanwhile, Asian countries are still struggling with digital transformation. Businesses in Western counterparts already embarked on hyper-automation or intelligent process automation– a new term that I only knew after the meeting. According to Gartner, hyper-automation is one of the top technology trends for 2022 [6].

Digital maturity – Malaysia

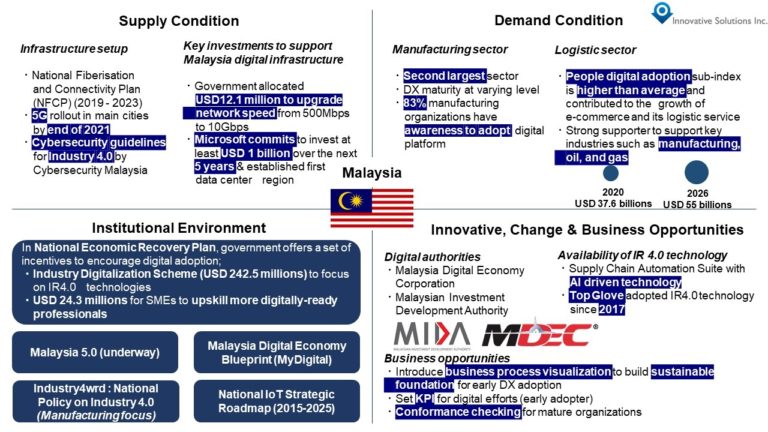

The information was arranged based on 4 key drivers in the abovementioned scorecard. The definition and scope of each key driver are shown in Exhibit 1.

- Supply condition – infrastructure setups and key investments to support Malaysia’s digital infrastructure

I would say the government is committed to upgrading internet infrastructure even though it is still not as good as a developed country yet. Last year, USD 12.1 million was allocated to this effort – to improve Infrastructure Network from 500Mbps to 10Gbps. 5G coverage will be available in three main cities; Kuala Lumpur, Putrajaya, and Cyberjaya by 2024, 80% of Malaysians may have access to 5G mobile coverage – a little bit behind. Below, I explain two main Government of Malaysia (GoM) initiatives and a key investment in Malaysia to upgrade infrastructure setup.

1.National Fiberisation and Connectivity Plan (NFCP) (2019 – 2023) and JENDELA

Through NFCP [7], GoM was planning to ameliorate digital connectivity quality in line with the recent 5G technology and the connection accessibility among the people. With better access to high-quality and affordable digital connectivity, it would contribute to uplifting lives and improving productivity which eventually empowers Malaysia’s digital economy growth. However, 3G networks are incoherently set up as a minimum network level in some parts of the country. Then, the pandemic hit, and the country has seen the urgent need for higher speed internet. Therefore, GoM formulated National Digital Network or JENDELA [8] which targets 4G coverage in residential areas throughout the country, put an end to 3G network service nationwide, and gradually roll out 5G network in premise areas. According to JENDELA quarterly report (for the period of 1 July – 30 September 2021), 100% of customers have migrated from 3G networks and 95.4% of carriers have switched off their 3G network service.

2.Cybersecurity guidelines for Industry 4.0 by Cybersecurity Malaysia – Malaysia Cyber Security 2020-2024

As businesses across the globe are undergoing massive digital transformation amidst pandemic, resilient cybersecurity infrastructure becomes a key driver to protect valuable digital assets which are exposed to cyber threats. With a vision to secure nation cyberspace, Malaysia developed and formulated Malaysia Cybersecurity Strategy 2020-2024 [9] and established several relevant agencies to reinforce local capabilities to predict, detect, deter, and respond to cyber-attacks through their 5 pillars; 1) Effective governance and management, 2) strengthening legislative framework and enforcement, 3) catalyzing and class innovation, technology, R&D and industry, 4) enhancing capacity & capability building, awareness and education, and 5) strengthening global collaboration.

Besides, for Industry 4.0, Cybersecurity Malaysia provided a cybersecurity guideline as the manufacturing industry is also exposed to data breaches and cyber-attacks when digital technology is widely adopted across the sector.

3.Microsoft commits to invest in “Together with Malaysia” initiative

In May 2021 [10], GoM partnered with Microsoft to launch the first data centre region in Malaysia to promote an inclusive digital economy and expected to spawn USD 4.6 billion worth of new revenue into the country’s digital ecosystem over the next five years [11].

- Demand condition – Manufacturing and logistic sectors

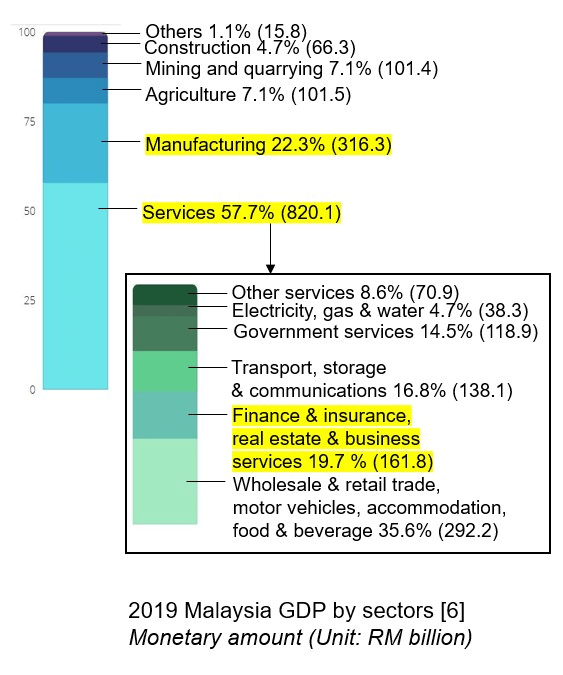

For the demand condition, I focus only on manufacturing and logistic sectors as ISOL has been involved with clients from these two arrays. Besides, the manufacturing sector is the second-largest sector that contributes to Malaysia’s GDP based on the Central Bank of Malaysia & Department of Statistics Malaysia in a 2019 GDP report as shown in Exhibit 2. According to IDC, the level of maturity for the manufacturing sector in Malaysia is at a varying level. However, 83% of manufacturing organisations have the awareness that they have to adopt the digital platform to gain a competitive edge in their business. In a similar report, they predicted top future technology applications investments for Malaysia manufacturers are; 1) Enterprise Resource Planning, 2) Supply Chain Management applications, 3) Manufacturing Execution System, 4) Manufacturing dashboards, data analytics & BI and AI applications, and 5) Sales & Operations / Integrated Business Planning [12].

In Malaysia, the people’s adoption sub-index is higher than average [13], contributing to the growth of the e-commerce sector and its logistic service. Pandemic drives consumer behaviour changes in many countries around the world including Malaysia and triggers the growth of the e-commerce sector. The Malaysian logistic sector has been supporting key industries, for instance, manufacturing, oil, and gas. The size of Malaysia’s logistic market is predicted to continue growing from USD 37.6 billion in 2020 to USD 55 billion in 2026 [14]. In line with e-commerce market growth, e-commerce logistic companies are now applying the recent IR4.0 technologies such as automation, robotics, Internet of Things (IoT), Big Data Analytics, cloud-based computing, and in-house software systems to support daily operations and high demand [15].

- Institutional Environment

The institutional environment plays an important role in providing conducive ecosystems to drive the digital economy growth in a country. Based on my research, the GoM has launched multiple initiatives to ride the digital wave and to ensure Malaysia is not left behind in the Industrial Revolution 4.0 era such as Malaysia Digital (the most recent one and had a soft launch in Dubai Expo 2020), MyDIGITAL or Malaysia Digital Economy Blueprint, Industry4WRD, National IoT Strategic Road, etc. But this time I will only briefly explain MyDIGITAL and Industry4WRD.

Briefly speaking, in MyDIGITAL [16], GoM has outlined several initiatives and targets which have been planned to be carried out in three phases until 2030 under six thrusts namely; 1) drive digital transformation in the public sector, 2) boost economic competitiveness through digitalization, 3) build enabling digital infrastructure, 4) build agile and competent digital talent, 5) create an inclusive digital society, and 6) build a trusted, secure and ethical digital environment. The initiatives are in line with the 12th Malaysia Plan and the Vision for Shared Prosperity 2030. The participation of three stakeholders mentioned in the blueprint – society, businesses, and government – are prominent in achieving the set targets. As the blueprint is designed to emphasize human-centric values, society would feel the most impact.

On October 13th, 2018, GoM launched the National Policy on Industry 4.0 aimed at boosting digital transformation in the Malaysian manufacturing sector and its related services by facilitating companies to embrace the related technologies systematically and comprehensively [17]. The end goal is for Malaysian manufacturers to be stronger through smart technologies. Industry4WRD is an initiative to transform the manufacturing industry by adopting IR4.0 technology among local businesses. The policy aims to assist SMEs in manufacturing to embrace the IR4.0 technology and ultimately realize the country’s goal to make Malaysia a primary destination for high-technology industries in the region. Through Industry4WRD, GoM provides assistance in crucial aspects such as funding and expertise to help SMEs in the manufacturing sector be able to embrace IR4.0 in their operations.

- Innovation & change

There are multiple digital authorities or government agencies that are responsible to develop conducive ecosystems for digitalization which eventually promote the growth of the digital economy in Malaysia for instance, Malaysia Digital Economy Corporation (MDEC), Malaysian Global Innovation & Creativity Centre (MaGIC), and Malaysian Research Accelerator for Technology and Innovation (MRANTI).

Besides, several Malaysian cutting-edge start-ups bring innovation into the marketplace or provide services such as Aerodyne and Carsome hence showing Malaysia never lacks talent and innovations. Aerodyne is a company based in Malaysia that provides drone-based powered by artificial intelligence service and ranked first in the world according to Drone Industry Insights 2021 [18].

Conclusion

References:

[1] https://www.bain.com/insights/e-conomy-sea-2020/

[2]https://www.weforum.org/agenda/2021/11/remote-work-employment-employeers-covid-pandemic

[3] IDC-Maxis Digital Transformation in Malaysia 2020 Whitepaper, Digital Transformation Executive Sentiment Survey 2019

[4] https://hbr.org/2020/12/which-economies-showed-the-most-digital-progress-in-2020

[5] https://digitalintelligence.fletcher.tufts.edu/trajectory

[6]https://www.gartner.com/en/information-technology/insights/top-technology-trends?utm_medium=social&utm_source=linkedin&utm_campaign=SM_GB_YOY_GTR_SOC_SF1_SM-SWG-TTT22&utm_content=&sf251590510=1

[7] https://www.mcmc.gov.my/skmmgovmy/media/General/pdf/MEDIA-STATEMENT-ON-NFCP.pdf

[8] https://www.malaysia.gov.my/portal/content/31120

[9] https://asset.mkn.gov.my/wp-content/uploads/2020/10/MalaysiaCyberSecurityStrategy2020-2024.pdf

[10] https://news.microsoft.com/en-my/2021/04/19/microsoft-announces-plans-to-establish-its-first-datacenter-region-in-malaysia-as-part-of-bersama-malaysia-initiative-to-support-inclusive-economic-growth/

[11] https://www.businesstoday.com.my/2021/04/19/microsofts-investment-in-malaysia-to-generate-us4-6-million-in-new-revenues/

[12] IDC 2021 Manufacturing Insights Survey 2020

[13] World Bank Malaysia’s Digital Economy Report 2018

[14] Malaysia Freight and Logistics Market – Growth, Trends, COVID-19 Impact, and Forecasts (2021 – 2026)

[15] MIDA e-Newsletter Feb 2021

[16] Malaysia Digital Economy Blueprint

[17] https://www.malaysia.gov.my/portal/content/30610

[18] https://droneii.com/drone-service-provider-ranking-2021